Are You Searching for Health Insurance in Spring Hill, TN?

Get in touch with Custom Health Advisors now to book a free consultation with a health insurance agent in Spring Hill. We're ready to help you find the perfect plan for your needs.

Health Insurance Agent Spring Hill, TN

At Custom Health Advisors, we serve the Spring Hill community and can help you understand the complex American healthcare system and find the best insurance for your situation. Whether you need individual and family plans, business plans, or coverage for travel professionals, I’m here to assist. Call me, a health insurance agent in Spring Hill, TN, today at 615-988-8700 for a free consultation.

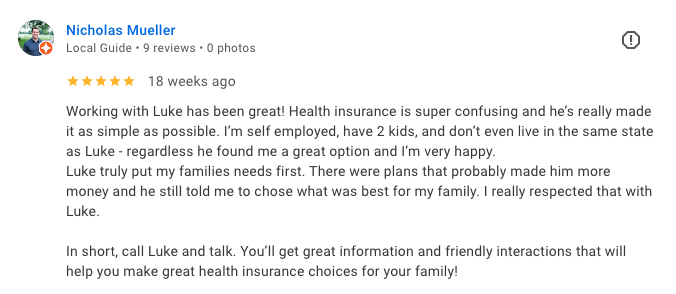

Recent Reviews

Can You Get Health Insurance in Tennessee?

In Tennessee, health insurance is available to lower your cost for medical expenses, and protect your assets from exposure to major medical bills in the event of a significant health emergency. You can get insurance policies through employers, the health insurance marketplace, and private insurers with different options based on your wants, needs, and budget.

How you utilize healthcare will determine which type of coverage that makes sense for your situation. There are plans based on health history, household income, deductibles, networks, start dates, and term length. It’s important to identify what your needs are, that way we can find the right coverage for you.

At Custom Health Advisors, I specialize in helping my clients navigate the different types of health insurance policies for all different types of situations.

What Does an Insurance Advisor Do?

A health insurance advisor helps you find the best insurance plan for your needs. I understand all the different types of insurance products and can explain them to you in a simple, transparent way. When you talk with a health advisor, I will ask you about the type of coverage you are looking for, your budget, and your health needs. Then, I will show you different plans that fit your needs, help you compare them, and address any general healthcare or insurance questions along the way.

What Sets Apart a Broker From a Health Insurance Agent?

Although they typically have different practices and procedures, a broker and a health insurance agent can help you find coverage.

Brokers partner with various insurance companies, allowing them to compare different plans to find the most suitable one for you. They also assist with managing claims and adjusting your policy. On the other hand, an agent typically represents a single insurance company and specializes in explaining its plans to you. They guide you in selecting a plan and handle the necessary documents, but don’t have access to as many different plans.

If you’re in Spring Hill, TN, I’d love to discuss any questions you may have. Call your health insurance agent in Spring Hill at Custom Health Advisors today to schedule a free consultation at 615-988-8700.

Health Plans From Custom Health Advisors

Private Market Plans

Most private health plans require applicants to be healthy and complete an application. They feature nationwide Preferred Provider Organization (PPO) networks and provide adjustable plan options. Some policies can be guaranteed-renewed until age 65. These plans also include add-on benefits like life insurance, short-term disability support, coverage for dental and vision, protection from accidents, and critical illnesses.

Many plans cover upfront costs for essential health services such as prescriptions, X-rays, lab tests, urgent care visits, chiropractic treatments, preventive care, and visits to primary care doctors or specialists. Short-term coverage options are also available for people who need insurance for one to six months.

Public Market Plans

Health plans from the Obamacare marketplace cover pregnancy-related services, mental health care, and pre-existing conditions you already have. They can be expensive, but the government offers tax credits based on how many people are in your household and your income to lower costs. If your income is higher than a certain amount, you are required to pay the “sticker” price.

You can enroll in these plans every year during Open Enrollment from November 1st to January 15th. There are also special enrollment periods when you can sign up if you have major life changes like losing your current insurance, starting a new job, moving, having a baby, losing insurance, etc. These plans usually only work in your state or nearby areas and often use smaller groups like Exclusive Provider Organizations (EPOs) or Health Maintenance Organizations (HMOs).

Individually Underwritten Plans

All of Custom Health Advisor's underwritten plans are designed specifically for each person, involving a meeting with all employees. These choices provide personalized options and can often save employers and employees money. Employers might give an allowance or stipend to help with monthly health insurance costs. These plans need less input from employers and give employees more freedom to pick their coverage.

Guaranteed Issue Plans

Employer-provided guaranteed issue plans offer extensive coverage, including:

existing health conditions

expensive medications

maternity care

mental health services

These plans also require more employer participation, and premiums may be higher for smaller businesses. If you're a small business owner in Spring Hill, TN, I’d be happy to discuss potential options for your business. Give a Spring Hill, TN, health insurance agent at Custom Health Advisors a call today at 615-988-8700.

3. Plans for Travel Professionals

Nationwide networks of insurance for travel professionals like consultants, sales reps, truck drivers, contract workers, doctors, and nurses are often required to meet their unique healthcare needs while they are on the road. With frequent travel itineraries, it's important to have access to healthcare anywhere in the United States.

Being connected to a nationwide network of doctors and healthcare providers ensures you can get the care you need whenever and wherever necessary. Selecting the right plan is critical, so let’s start with a quick chat about your current situation to find the best coverage for your situation.

What Does POS Network Mean?

A Point-of-Service (POS) is a form of health insurance allowing you to choose doctors and hospitals with more freedom than an HMO. With this plan, you can select primary care and specialist doctors from the network who can provide the medical services you require without having to have a referral from a PCP.

Though it might be more costly, a POS plan also lets you see doctors and specialists outside the network. This plan combines features of Preferred Provider Organizations (PPOs) and Health Maintenance Organizations (HMOs), which gives you more control and choice in your healthcare.

With a Point-of-Service Plan, your primary care doctor coordinates your care, yet you can still see providers that are out-of-network. This can be especially helpful if you need specialized care not available within the network. Contact Custom Health Advisors, your health insurance agent in Spring Hill, TN, to request a free consultation.

FAQ’s On Health Insurance

-

Deciding whether to switch to an ACA-compliant plan or keep your current individual health policy depends on what's best for your health and budget. These plans often cover more medical services for pre-existing conditions and can offer financial help based on your income, which might make them more affordable.

Your current plan might already meet your needs or be more cost-effective. It’s important to compare both options carefully. Consider things like how much you pay each month, what doctors you can see, and what benefits are included. Custom Health Advisors is here to help you understand your choices and find the right plan for you.

-

As a business owner, deciding whether to buy health insurance through the exchange or a broker depends on what works best for your company. The exchange offers a range of plans that meet government standards and may qualify you for subsidies based on your income.

A broker can provide personalized advice and help navigate the options outside the exchange, offering plans that may better suit your business's specific needs. Considerations are cost, coverage options, networks, renewals, and the level of support you need.

-

If you can't get a long-term plan and don't have a qualifying event, there are still other options available to ensure you have coverage. You could explore catastrophic health insurance plans, which provide coverage for major medical expenses but have certain eligibility requirements.

Some states also offer special enrollment periods or state-specific health insurance programs outside of the typical open enrollment periods. Custom Health Advisors can help you explore these alternatives and find a solution that meets your health needs and financial situation.

In Spring Hill and across Tennessee, Custom Health Advisors offers tailored advice on health insurance. With 15 years of experience, we know insurance options well and can help you find the right plan.

Our team listens to what you need and helps you make sense of the often confusing world of insurance. Whether it's coverage for you, your family, or your business, we provide the needed support to determine the best solution. Count on us for great service and clear help every step of the way.

Choosing Custom Health Advisors Guarantees a Good Experience

Contact Custom Health Advisors

If you're looking for quality health insurance, a Spring Hill, TN, health insurance agent at Custom Health Advisors is ready to assist you. We'll walk you through the perplexing U.S. healthcare system and help you choose the right plan. We'll be there with you every step of the way as you get health insurance. Reach out today to set up a free consultation.